Contents:

With a future contract, as a buyer or seller, you can buy or sell a specific commodity in the future at a strike price which is a predetermined price. Put options can be termed as being in, at, or out of the money. In the money refers to the situation when the underlying stock price is below the put strike price. When the underlying price is above the strike price, it is called out of the money.

These area unit acrylic-based elastomeric coatings, that shield wet areas from perpetually occurring water leakages. Fxedeal is a trusted broker for multiple asset classes including Forex, Indices, Commodities, Shares, Energies, Metals and Crypto Currencies. Change in the composition of an Index – Periodic rebalancing of indices is done globally where some companies are removed, and different companies take their place. The Regional Office will handle work as per existing delegation and shall continue to report to functional heads for specific departmental functions while reporting administratively to SEBI Executive Directors. The Human Resources Division will perform all the functions in its role as the principal personnel and human resources authority in SEBI.

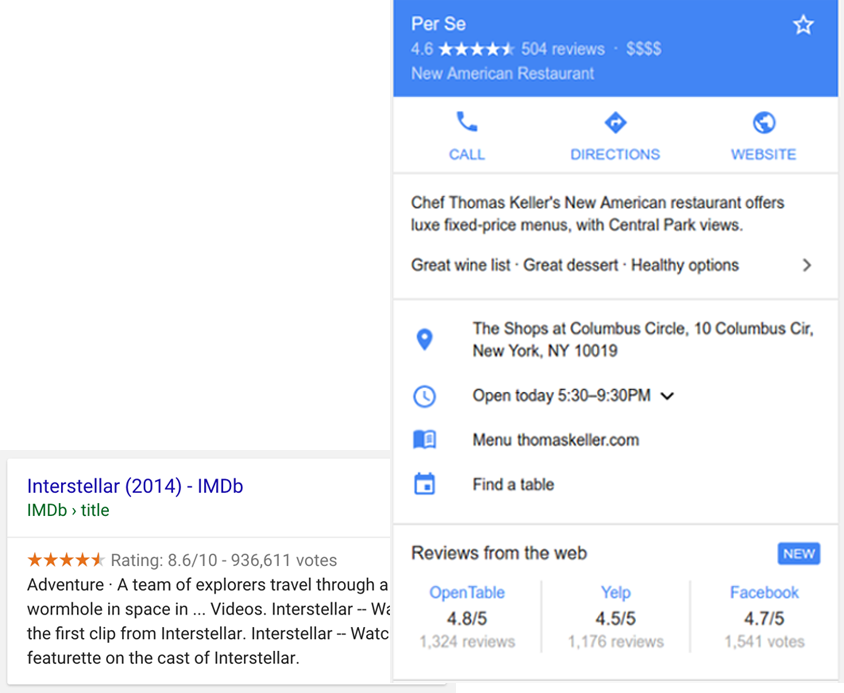

It is advisable to trade in index options only using theLimit order type and not market orders. The Brokerage applicable on Nifty Options and other Index Options with SAMCO is on a per order basis irrespective of the number of lots in a particular order. Calculate the brokerage and transaction expenses for trading nifty options at SAMCO’snifty options brokerage calculator.

Both these indices are extremely liquid and also actively traded by retail and institutional investors. Index futures trading in India evolved as a corollary to trading in stock futures which was almost akin to the erstwhile Badla system on the BSE. Apart from looking at trading strategies in index futures, let us also see how traders can actually benefit from trading in index futures.. An index is a measurement of the price of a single item or a collection of assets. Index futures are derivatives, which means they are based on an underlying asset .

Exchange Traded Funds (ETFs)

The Recovery and Refund Department deals with recovery proceedings against the defaulters who have failed to pay the penalty, fees, disgorgement amount or monies directed to be refunded to investors and refund of such monies. E) Trading / Trading in “Options” based on recommendations from unauthorised / unregistered investment advisors and influencers. B) Trading in leveraged products /derivatives like Options without proper understanding, which could lead to losses.

Stock futures inch up Tuesday as March inflation report looms ahead: Live updates – CNBC

Stock futures inch up Tuesday as March inflation report looms ahead: Live updates.

Posted: Tue, 11 Apr 2023 07:22:00 GMT [source]

Hey, I have discovered this amazing financial learning platform called Smart Money and am reading this chapter on What are Index Futures in Trading ?. Trading an index is similar to trading a stock, currency or commodity. Waterproofing of wet areas like Toilets, bathrooms, kitchens, Sinks and balconies is crucial on account of the constant use of water.

India Market

Now the Bank Nifty, for example, the heaviest weighted stock is HDFC Bank. The Bank Nifty will go largely where HDFC Bank will want to go on a routine day. I’ll try to take a 360 degree world view of the whole exercise and I’ll share with you my reasons why. Dividends received by an ETF are typically reinvested in the Fund. The company announced that its board will hold a meeting on Wednesday, 19 April 2023, to consider various proposals of raisin… However, each stock will come with a different price and price change in one stock would not be equal to the price range in another stock.

The stocks of businesses which are the main contributors to that particular sector in an economy are combined to form an index. If the index is doing well, it means that the sector is bullish or the prices of stocks have risen. If the value of an index has fallen, you can believe that the market is bearish or that the prices of stocks have fallen. This basic idea about Stock and Index Options will help you to choose contracts that are right for you. Start by doing a few trades to familiarize yourself with practical option trading.

DGCI&S should immediately revise the current base year ( ) of indices of Unit Value and Quantum of Foreign Trade and the corresponding indices of terms of trade. It is calculated by subtracting % of stocks near their 52W low from % of stocks near their 52W high to arrive at the net % of stocks near their 52W high. This is the net open interest of FIIs in Index Futures on the NSE. Tracking movement in this indicator gives an insight into FII views about the markets.

What Is SEBI Its Meaning and Functions In Stock Market

A futures contract allows a buyer or seller to buy or sell a specific commodity in the future at a strike price which is a predetermined price. Stock futures will enable you to purchase a certain quantity of a specific stock at a predetermined price in the future. Before we begin to understand index futures, let us revise what futures contract is.

erp software solutions factor Index trading can be highly risky when compared to other modes of investing. As it contains the stocks of the biggest companies in the whole market, it makes it highly speculative and volatile. A slight price fluctuation in the stock price of any of the company can negatively affect the overall market trend, tanking the share prices of other companies also. A put is an options contract that gives the buyer the right to sell the underlying asset at a specific price at any time up to the expiration date. When the stock price is below the underlying stock value, and if a trader buys the option to sell and buys the stock also, then the trader will make a profit because the purchase price was lower than the sell price.

What are Stock Market Indices?

Of course, traditional Mutual Fund investors are also subjected to the same trading costs indirectly, as the Fund in turn pays for these costs. Investors typically seek exposure to equity markets, but often need time to make investment decisions. ETFs provide a “Parking Place” for cash that is designated for equity investment. Because ETFs are liquid, investors can participate in the market while deciding where to invest the funds for the longer-term, thus avoiding potential opportunity costs.

Internal factors regulating the internal business conditions of the companies, like the appointment of a new CEO or launching of a new product. Once included in a particular index, the company is given a certain weightage. This weightage defines a company’s ability to regulate the index by that percentage. For example, if a company has a weightage of 8% in NIFTY50, it means that it can influence the index’s price by 8%.

- Execution costs are lower and therefore returns to the investor is relatively higher, as compared to the execution costs of equity mutual funds, a diversified mutual fund.

- This is the net open interest of FIIs in Index Futures on the NSE.

- Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

- Take your pick as to whether you are an index trader or you’re an individual stock trader.

The smaller denominations in which https://1investing.in/ trade relative to most derivative contracts provides a more accurate risk exposure match, particularly for small investment portfolios. Stock market indices are considered not just an advantage but also a necessity. The importance of stock market indices helps companies to make their investment safer and more accessible.

If the Nifty goes up to 15,810 on Wednesday and the Nifty option goes up to Rs.70, then you book a profit of Rs.1,200 on the trade and walk out with a profit. Either way, your maximum loss on this index options trade can never be more than Rs.4,050. Of course, when you add up the brokerage and statutory charges, you would find that the minimum loss is higher than that but that is the whole idea. What happens if you buy the Nifty 15,800 call option at Rs.54? Nifty has a minimum lot of 75 shares of Nifty so that is the bare minimum you need to buy. So, buying one lot of Nifty 15,800 call option will cost you Rs.4,050.

Changes in the price of underlying assets impact the overall value of the index. For example, the USDINR option is an option to buy the Dollar or go long on the dollar, or go short on the rupee. You can buy a call option or put an option on the USDINR based on your view of the dollar appreciating or depleting in value vis-à-vis the rupee. In the Indian options market, it is the index options that are a lot more popular and liquid. Just as a stock is an option on a stock, the index option is an option on a well-accepted index like the Nifty, Sensex, Bank Nifty, etc.

Currently, Indian markets permit the trading of index options on the Nifty and Bank Nifty on a monthly and weekly options basis. The monthly options expire on the last Thursday of the month while the weekly options expire every Thursday. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

A better way is to add index futures of FMCG index and IT index to your portfolio. This will help you structurally diversify your portfolio with minimal risk and investment outlay. You can sell banking stocks that you own or you can short sell them in equity markets. But since Indian markets follow rolling settlements, you can only short in equities for intraday basis. The other option is to sell stock futures of specific banks but here again you are running bank-specific risk. You can overcome all these problems by just selling the index futures of Bank Nifty.

There is no way to predict good entry and exit times in the market with absolute accuracy. However, MMI provides a sound starting point of indication backed by exhaustive testing. The current indication is that the market is in the Extreme Greed zone. Skew is calculated as the difference between implied volatilities of OTM put options and OTM call options of NIfty 50. Higher than average value suggests bullish FII views about the markets.